Automation journeys come in many shapes and sizes, but often start within a business unit, such as finance and accounting (“F&A”), or led from the IT organizations. Regardless of where it starts, how much control and responsibility the finance and accounting team takes on is often debated. It’s also true that F&A teams cannot effectively automate processes without any IT involvement, likewise, an automation program cannot be successful without financial support. The exact location of the line in the sand may differ slightly, company to company, but finance and accounting should be willing to step up and lead their investments in automations and take on as much responsibility as they can.

Establishing A Center of Excellence

The Center-of-Excellence(“CoE”) can be housed under F&A, which is a good starting point for many organizations. If you want to automate your finance function and bring lower costs to operate the financing and accounting needs, taking control can provide you with numerous benefits. This includes prioritization of your processes that align with your strategic vision, controlling resource investments and commitments, and insuring SOX control frameworks are adhered to at the onset. It’s not surprising that some finance organizations can feel underserved by their IT partners, as ITs responsible for supporting the whole organization and finance operations can take a back seat to other priorities. This does not mean that IT should be left aside.

IT will have a role, even if you run your own automation program end-to-end, and you will need them to have a seat at the table. You will want to avoid creating a shadow IT group and truly focus your financial resources on process improvement and automation. It’s best practice to leverage your IT team for infrastructure, network security, understanding ERP/system schedules, roadmaps, and disaster recovery processes (at a minimum). It is also recommended to adopt the cloud version of the tools, which can significantly reduce the needs of your IT org, but even then your IT org likely controls the user/VPN access that you will have to grant access for bots and developers to automate.

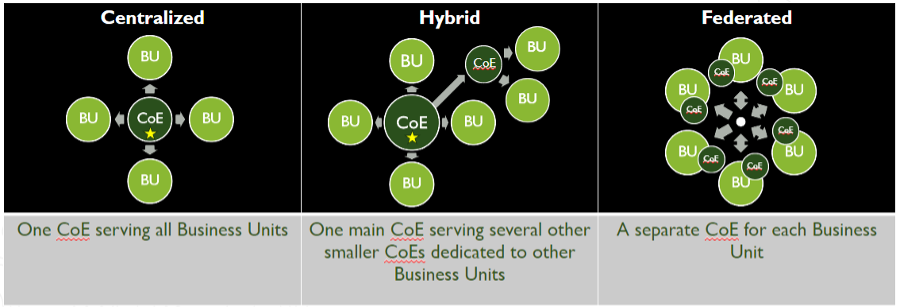

IT may have already started the CoE, but that doesn’t mean F&A can’t get behind the wheel and drive their own automations. It does mean that you will need to explore a new operating model. It may be that a hybrid fit is more valuable, or it could mean a federated model makes more sense. Either way, it will ultimately be discussed and decided with the executives’ sponsors and IT.

The added benefit of IT already developing a CoE, is that many foundational activities may have been performed and decided that you and your finance-led CoE can leverage.

All this means is you must play well within the sandbox, communicate at all levels of the organization, and come to an agreement on that line in the sand; who does what? Don’t let egos get in the way. It’s possible that when looking at improving or automating a process, the best path is to do so in your source ERP system or application. The work done by the CoE, evaluation and documentation is still relevant in getting the improvements and saves you need. It is also possible that the short-term automation is cheap to deploy and run during the period before IT can develop and deploy in the source system. Don’t get in the way of making the best decision for the company and work with IT partners on the whole picture.

You may also be thinking that finance doesn’t house technologists in the same way as an IT org would. I would argue two points here. The first being that the future of finance teams will have to elevate their technological expertise or get left behind. To evident this further, you likely know that the CPA exam is evolving to include a technology core and information systems and control discipline in their new CPA model. F&A professionals will need to be masters of the software they run to get their job done. The foreseen need and expertise around financial technology teams to only grow in complexity and value and bringing a CoE into F&A will put you in front of that need.

The second point is that while automations can be complex, to get started you don’t need to have a programmer. All you truly need to start is a business analyst with that process forward/improvement mindset that knows your finance processes, system, and key players to start with a pilot/proof of concepts.

The Benefits of Embracing Automation

F&A teams should embrace automation and take a leadership role in this technology for their own benefit. The benefits will outweigh any growing pains and you will be able to focus these efforts directly on your strategic vision. Keep IT involved and informed but don’t be afraid to take the wheel and define where the line in the sand is. Find your team members that are strongest at data analytics, reporting/visualizations, and process forward thinkers to start the journey with process improvement and automation as the core focus. CPAs may surprise you in how technically adept at software they can be!

Sources:

https://blog.aicpa.org/2020/07/cpa-licensure-one-step-closer-to-change.html#more